Federal judge gives roadmap to hammer sellers for the illegal calls of their telemarketers

- Peter Schneider

- Mar 29, 2024

- 11 min read

Updated: Apr 14, 2025

Most illegal calls these days are initiated from telemarketers over in the third world. One company calls, another company screens, and if they think they found a customer, they transfer you to an American company to close the deal.

That is the general fact pattern in Hossfeld v. Allstate Ins. Co., No. 20-CV-7091, (N.D. Ill. Mar. 28, 2024). Two independent Allstate agents hired a company called Transfer Kings to find potential customers, and in turn Transfer Kings hired a company called Atlantic Telemarketing to initiate the calls.

Hossfeld got called (after already being on Allstate's do-not-call list!) and Hossfeld named Allstate as a defendant asserting vicarious liability for the actions of its agent. This was required because ""It is undisputed “that Allstate did not ‘direct’ its insurance agents to make the specific calls to Plaintiff” at issue." While Allstate didn't hire Transfer Kings, Allstate knowingly allowed their agents to do so.

"During the relevant time period, Allstate permitted its agents “to engage Non-Contracted Telemarketers to initiate calls to consumers for the purpose of encouraging the purchase of Allstate products and services, so long as the agent and Non-Contracted Telemarketers compl[ied] with [Allstate’]s Agency Standards and incorporated [written] Do Not Call Policy.”"

Well, giving away the ending, the court is going to rule:

"Regarding agency law, the undisputed summary judgment evidence establishes that Allstate’s agents appointed Transfer Kings, which in turn appointed Atlantic, as subagents, rendering Allstate vicariously liable for their TCPA violations."

This judge is going to give other plaintiff's a class in how to hold principals accountable for the money making illegal phone call operations of their agents.

A another standard ploy Allstate tried is the "our contract says they have to follow the law" defense. "Fleming and Gilmond also agreed to be bound by Allstate’s Agency Standards . . . The Agency Standards include the following language:"

"Agencies should ensure that an external provider offering services through these channels complies with all components of these corporate policies and applicable state and federal laws and regulations. However, you [the agent] are ultimately responsible for ensuring that telephone calls, texts and emails sent by your agency, or any outside vendor on your behalf, comply with applicable federal and state laws. "

Does this qualifying you in a phone call and then transferring you to the Seller sound familiar?

"Although there are factual disputes concerning other timeframes, no party disputes that, “by around November 2020 and thereafter when Plaintiff received his calls, Transfer Kings/Atlantic marketed different insurance products.” Pl.’s Resp. to SMF ¶ 73. In its training manual for telemarketers, Transfer Kings describes its business model as follows: “We cold call customers and let them know that X insurance company has lowered their rates for home and car insurance by up to whatever % we promote and we would like to provide them with a free comparison quote so they can see how much they can save in comparison to what they’re paying with their current insurance provider.” Def.’s Ex. N at 3 (no date provided); see also Pl.’s Resp. to SMF ¶¶ 74–75; Pl.’s Resp. to SAF ¶ 16. The training manual includes a series of suggested “qualifying” questions the telemarketer should ask the prospect before deciding to which of several insurance providers, such as Farmers, Liberty Mutual, or Allstate, to transfer the call. See Def.’s Ex. N at 4. Regarding do-not-call requests, the training manual states, “If a customer tells you they’re on the DO NOT CALL LIST apologize and let them know you will put them on our internal DNC list.” Id. at 7. If a customer reports having previously asked to be placed on the internal do-not-call list, the manual instructs the telemarketer to apologize, hang up, and bring the matter to a manager’s attention"

In this case, Transfer Kings might transfer the call to one of several insurance companies. When sued, Sellers like Allstate often try to duck responsibility for the calls saying the Telemarketer was calling for lots of different companies. This case shows that defense doesn't work.

Mentioned above, Hossfeld's phone number was already on Allstate's DNC list. The Court's opinion blames no-access to Allstate's system for the calls:

"Transfer Kings did not scrub its lists of numbers to be called against Allstate’s internal do-not-call list in part because, at the time, non-contracted Allstate vendors did not have access to Allstate’s tool for scrubbing lists. Allstate agents, including Fleming and Gilmond had access to Allstate’s tool for scrubbing numbers against its internal do-not-call list."

The truth is probably a little different than this - When Transfer Kings initiates the calls, they didn't know who they would transfer the call to first, and then try if that didn't work, and so on. So they can't scrub the calling lists because they are calling for lots of different folks.

Further, most companies like Allstate simply reject incoming transfers that are on their internal DNC list under the thought process that if they don't accept the call, they won't be held responsible for it. They don't feel much pressure to make their telemarketers are scrubbing their calling lists because they don't think they have liability for calls they don't actually answer.

Pro tip - if you are getting these calls and the Seller won't accept the transfer and you can't identify them, get an "investigation" phone with a phone number not associated with you. Use social engineering to have the Telemarketer call you back on the investigation phone, that way the Seller probably will accept the transfer and you can learn who they are.

Allstate, of course, tried fighting back:

"Allstate strongly suggests that Hossfeld entered his phone number and pseudonym into a website called policygenius.com (“Policy Genius”) . . . In its briefing, Allstate points out that Hossfeld has filed other TCPA lawsuits and that he has used pseudonyms, including Michael Johnson, in the past. (the supposed opt in on Policy Genius was for a Michael Bradley)"

This blog has talked about playing defensive ball a number of times "Hossfeld asked that the calls from Allstate stop seven times" and giving evidence that engaging with telemarketers is for investigative purposes:

"Hossfeld cites his own deposition testimony and his declaration, both of which subject him to the penalties of perjury in which he states that he feigned interest in an insurance quote and used the false names Michael Johnson and Michael Bradley in an effort to gather enough information about who was calling to get the calls to stop. Allstate responds that this fact is disputed, but it cites no contradictory evidence. Allstate’s Resp. Allstate’s failure to cite controverting evidence leaves Hossfeld’s evidence undisputed . . . Allstate argues in a single sentence that “Hossfeld’s participation in the calls far exceeded that necessary to investigate.” Allstate does not further develop this argument; it does not explain, for instance, what specifically was unnecessary about Hossfeld’s conduct, which, based on the call transcripts and recordings, was consistent with Hossfeld’s stated motive. This “perfunctory and undeveloped” argument has been waived"

In playing defensive ball, don't spend hours on the phone. Get what you need, and get of the phone. Follow up with a DNC request if it could be argued you invited more calls by engaging with them to learn their identity.

"apparently feigned interest in insurance quotes, gave false names, and used assumed names. Hossfeld claims that he did so in an effort to gather sufficient information to cause the calls to stop, a claim that is undisputed on this record due to the absence of admissible evidence provided by Allstate. Given Hossfeld’s undisputed purpose, this conduct prolonged the calls but did not evince Hossfeld’s consent to further calls or transform Hossfeld’s injury into a self-inflicted one. Rather, the injury to Hossfeld was complete when Allstate placed each call to his phone number, thereby intruding upon his peace and diverting his attention and, as the regulation states, failing to honor his request not to be called by Allstate . . . Regarding Hossfeld’s requests for a callback number and his provision of a phone number at which some of the telemarketers could reach him if the call disconnected, the consent or invitation required by the TCPA must, as a matter of statute, be express. 47 U.S.C. § 227(a)(4), the express consent requirement means that “the scope of a consumer's consent depends on its context and the purpose for which it is given. Consent for one purpose does not equate to consent for all purposes.” "

Hossfeld didn't need it here, but his defensive ball play would have been better had he given an investigation phone number as the ball back number. This judge was fair "Even viewed in the light most favorable to Allstate, Hossfeld expressed a limited form of consent to continue the particular call so that Hossfeld could try to get the calls to stop." but you can't count on getting a fair judge.

Allstate tried to admit a hearsay document built on hearsay and this is a great citation:

"If the evidence is inadmissible hearsay, the courts may not consider it. And when a document contains multiple layers of hearsay, . . . each layer must be admissible.” Prude v. Meli, 76 F.4th 648, 660 (7th Cir. 2023) . . . to be admissible at summary judgment, “documents must be authenticated by and attached to an affidavit that meets the requirements of Rule 56(e) [since recodified as Fed. R. Civ. P. 56(c)] and the affiant must be a person through whom the exhibits could be admitted into evidence” . . . As a matter of evidence, satisfying the requirement of authenticating or identifying an item of evidence means “the proponent must produce evidence sufficient to support a finding that the item is what the proponent claims it is” . . . Furthermore, an affidavit or declaration at summary judgment “must be made on personal knowledge, set out facts that would be admissible in evidence, and show that the affiant or declarant is competent to testify on the matters stated” . . . Since the spreadsheet and witnesses’ testimony based on it are inadmissible, the following proposition must be deemed undisputed for want of admissible controverting evidence: Hossfeld “has never given written consent to Allstate – or anyone on Allstate’s behalf - to call his cell phone for purposes of telemarketing.”"

Allstate of course tried to wriggle out from under liability: "Allstate responds that it cannot be held directly or vicariously liable under either the internal do-not-call regulations or principles of agency law for the calls Hossfeld received."

"Allstate maintains that nothing in the text of the internal do-not-call regulations, 47 C.F.R. § 64.1200(d), requires it to coordinate its internal do-not-call lists with non-contracted vendors like Transfer Kings and Atlantic who market the services of multiple insurance companies . . . if Atlantic acted as Allstate’s agent when Atlantic called Hossfeld, Allstate is liable for Atlantic’s failure to honor Hossfeld’s do-not-call requests to Allstate . . . To succeed on his agency theory, Hossfeld must show “(1) a principal/agent relationship exists, (2) the principal controlled or had the right to control the alleged agent's conduct, and (3) the alleged conduct fell within the scope of the agency.”"

Allstate didn't dispute that the independent Allstate agents were Allstate's agents and that Allstate maintained complete control over them. "But Gilmond and Fleming [the independent Allstate agents] hired Transfer Kings, which subcontracted with Atlantic, and Atlantic placed the calls to Hossfeld. Hossfeld relies on a subagency theory to bridge the vicarious liability gap to Atlantic . . . An agent must have “actual or apparent authority from the principal” to appoint a subagent . . . A subagency theory has been recognized as a valid basis for imposing vicarious liability in TCPA litigation."

And that is exactly what Allstate did, they allowed their agents to employ subagents:

"An agent has actual authority to create a relationship of subagency when the agent reasonably believes, based on a manifestation from the principal, that the principal consents to the appointment of a subagent.” Restatement (Third) of Agency § 3.15 cmt. C. Allstate’s internal do-not-call policy recognizes that its agents will appoint telemarketing vendors and requires the agent to ensure that they comply with Allstate’s IDNC policy: “you [the agent] are ultimately responsible for ensuring that telephone calls, texts and emails sent by your agency, or any outside vendor on your behalf, comply with applicable federal and state laws . . . Under this language (what the Restatement calls a manifestation from Allstate) Gilmond and Fleming had authority to appoint subagents to place telemarketing calls, but they could not avoid their responsibilities as Allstate agents to comply with Allstate’s internal do-notcall policies. Indeed, Allstate has a separate written policy, Def.’s Ex. C-16, entitled “Complying with Allstate’s DNC Policy when Using External Vendors (2019-2020).” The undisputed evidence therefore shows, as Allstate agents, Gilmond and Fleming had actual authority to hire Transfer Kings."

Of course this case is even more complex, Transfer Kings employed its own subagent Atlantic. "Allstate contends that Hossfeld has not laid the necessary foundation in the summary judgment record to permit a finding that two layers of subagency"

The court didn't chase Transfer Kings around for the facts of how they hired Atlantic on this one, it looked from a higher perspective:

"Undisputed evidence in the record shows that Fleming and Gilmond paid for a certain number of leads, that they specified the target market (Texas), that they had the right to approve the script used, and that they specified the criteria used to screen (referred to as filters) callers, e.g., age, number of drivers in the family, and no accidents in the past three years . . . These undisputed facts demonstrate sufficient control by Gilmond to find a subagency relationship as a matter of law . . . No party argues that Gilmond or Fleming expressly or impliedly prohibited Transfer Kings from appointing a subagent, that any Allstate policy or practice forbade Transfer Kings from subcontracting, or that the practice in the industry was not to permit a vendor such as Transfer Kings from appointing subagents"

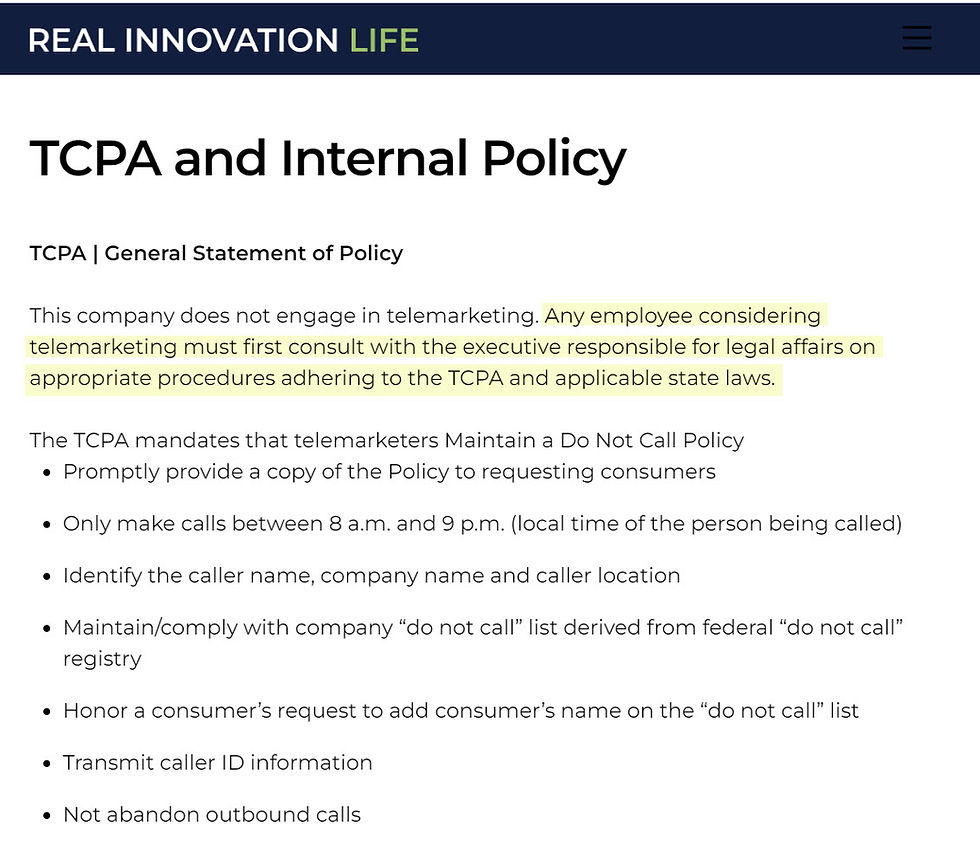

The court found Allstate liable for the calls under a direct authority theory which should make companies like Real Innovation Life very nervous because they openly advertise that their employees have the authority to engage in telemarketing:

Just like Allstate they have the boiler plate about the telemarketers following the law.

Allstate got hammered for poor choices, but at least they weren't willful or knowing, right? No so said the court. "District courts in the Seventh Circuit “generally have interpreted [willful or knowing] to mean voluntary, intentional, actions, and not to require specific knowledge that the action constitutes a violation of the TCPA."

"Allstate raises what amounts to a good faith defense. See Allstate’s Resp. Opp’n Summ. J. 23–24. It submits that it reasonably and in good faith believed that prior express consent or invitation is a defense to a TCPA internal do-not-call claim, that the . . . list of leads on which Hossfeld’s number appeared was represented to be 100% opt in, and that Allstate therefore had a good faith basis for not scrubbing the list against its internal do-not-call list. See id. Under the interpretation of § 227(c)(5) the court adopts today, to be knowing and willful the defendant’s “act [violating the TCPA must] be intentional or volitional, as opposed to inadvertent;” it does not require a showing “that defendant must have known that the conduct would violate the statute.” . . . On the contrary, the undisputed summary judgment evidence establishes that Fleming and Gilmond intentionally and volitionally hired Transfer Kings to place calls to sell Allstate services and that calls were deliberately placed to Hossfeld’s phone number . . . The court therefore grants Hossfeld’s motion for summary judgment on liability and willfulness under 47 U.S.C. § 227(c)(5)."

This federal judge just gave a road map to hammer sellers for the illegal calls of their sellers. Hopefully you now know better how to hammer sellers for the illegal calls of their telemarketers.

Would you like a free case review? Do you have a question or a telemarketing, debt collection, or bankruptcy case that would make a great blog article? We might even review your pro-se complaint or motion in a blog post. Email peter@nwdebtresolution.com and/or nathen@nwdebtresolution.com and we may answer it for everyone!

Are telemarketers harassing you in Washington, Oregon, or Montana? My Washington State TCPA plaintiff law practice can help, just give us a call at 206-800-6000 or email peter@nwdebtresolution.com.

The thoughts, opinions and musings of this blog are those of Peter Schneider, a consumer advocate and Washington State plaintiff's TCPA attorney at Northwest Debt Resolution, LLC. They are just that, his thoughts, opinions and musings and should be treated as such. They are not legal advice. If you are looking to file a lawsuit for TCPA violations and unwanted calls please contact me for a consultation.

Comments